Trust Foundation Honesty: Building Rely On Every Task

Trust Foundation Honesty: Building Rely On Every Task

Blog Article

Securing Your Assets: Count On Foundation Competence within your reaches

In today's complicated monetary landscape, ensuring the protection and development of your possessions is critical. Count on structures serve as a keystone for protecting your riches and heritage, offering a structured approach to asset defense.

Value of Trust Foundations

Trust fund structures play a vital duty in developing credibility and cultivating strong partnerships in various professional setups. Building depend on is crucial for companies to flourish, as it develops the basis of effective collaborations and partnerships. When trust is present, individuals really feel much more certain in their communications, causing boosted efficiency and performance. Trust fund foundations act as the foundation for moral decision-making and clear interaction within organizations. By focusing on count on, organizations can develop a positive job society where workers really feel valued and valued.

Advantages of Expert Support

Structure on the structure of count on expert partnerships, looking for professional guidance provides invaluable benefits for people and companies alike. Expert assistance offers a riches of expertise and experience that can help browse intricate financial, legal, or calculated difficulties effortlessly. By leveraging the know-how of professionals in various fields, people and companies can make informed decisions that line up with their goals and ambitions.

One substantial advantage of professional support is the capacity to gain access to specialized understanding that may not be readily available or else. Professionals can use insights and viewpoints that can bring about ingenious options and opportunities for development. Additionally, dealing with professionals can aid reduce dangers and unpredictabilities by supplying a clear roadmap for success.

In addition, specialist support can save time and resources by streamlining processes and staying clear of expensive blunders. trust foundations. Experts can provide individualized advice customized to details requirements, ensuring that every choice is educated and calculated. Overall, the benefits of expert support are multifaceted, making it a useful asset in guarding and maximizing assets for the long-term

Ensuring Financial Security

In the realm of financial planning, securing a steady and prosperous future depend upon tactical decision-making and prudent financial investment options. Guaranteeing monetary safety and security entails a complex approach that encompasses numerous aspects of riches administration. One important component is producing a diversified financial investment portfolio customized to discover this info here private danger tolerance and monetary goals. By spreading out investments throughout different possession classes, such as supplies, bonds, property, and assets, the risk of significant economic loss can be alleviated.

In addition, maintaining an emergency situation fund is use this link necessary to guard versus unforeseen expenses or earnings disruptions. Specialists suggest reserving 3 to six months' well worth of living costs in a liquid, quickly accessible account. This fund functions as a monetary safety and security net, offering satisfaction throughout stormy times.

Frequently examining and adjusting economic plans in action to transforming conditions is also paramount. Life occasions, market changes, and legislative adjustments can influence monetary stability, highlighting the importance of continuous analysis and adjustment in the pursuit of long-term financial safety and security - trust foundations. By carrying out these techniques thoughtfully and constantly, people can strengthen their financial ground and work in the direction of a much more secure future

Securing Your Assets Efficiently

With a solid foundation in place for financial safety and security through diversification and emergency situation fund upkeep, the following vital step is safeguarding your possessions properly. Securing properties includes shielding your riches from prospective risks such as market volatility, economic declines, lawsuits, and unexpected expenses. One effective strategy is possession allotment, which entails spreading your financial investments across various asset classes to reduce risk. Diversifying your portfolio can aid minimize losses in one location by stabilizing it with gains in one more.

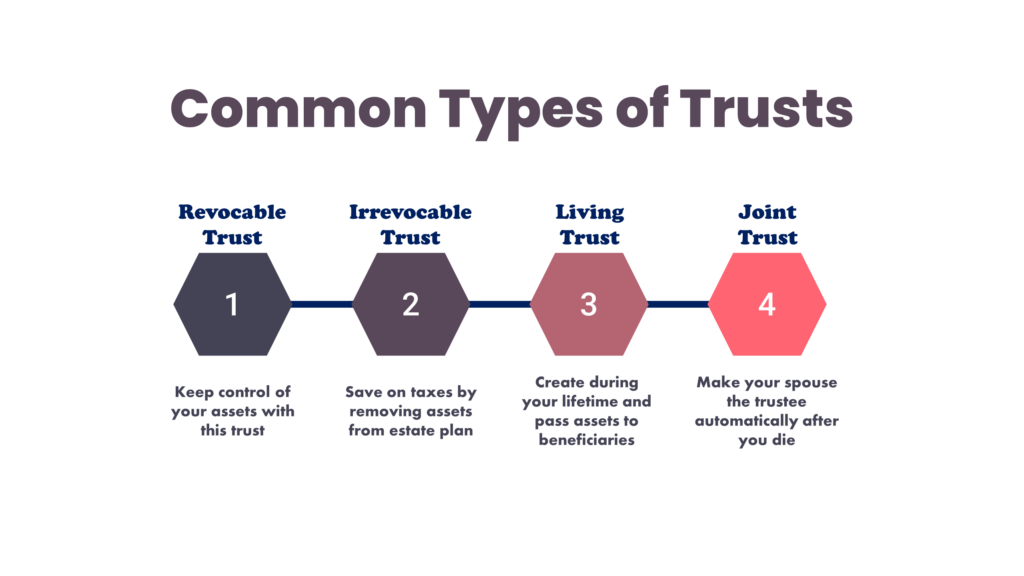

Additionally, developing a trust fund can use a protected method to shield your assets for future generations. Counts on can aid you regulate just how your possessions are distributed, reduce inheritance tax, and safeguard your wealth from creditors. By executing these strategies and seeking specialist suggestions, you can protect your assets efficiently and secure your monetary future.

Long-Term Asset Protection

Long-lasting property security includes implementing actions to protect your assets from various dangers such as economic downturns, suits, or unexpected life events. One crucial aspect of long-term asset security is developing a depend on, which can use substantial benefits in shielding your assets from lenders and lawful disputes.

Furthermore, diversifying your investment profile is another key approach for lasting possession security. By spreading your investments across various possession classes, markets, and geographical areas, you can minimize the effect of market changes on your overall wealth. Furthermore, frequently assessing and updating your estate plan is important to make sure that your possessions are protected according to your wishes in the long run. By taking an aggressive approach to lasting property defense, you can safeguard your wealth and supply financial protection on your own and future generations.

Final Thought

In final thought, trust foundations play a critical duty in guarding possessions and ensuring economic security. Specialist assistance in developing and taking care of trust frameworks is vital for long-term possession protection.

Report this page